We also reference unique research from other highly regarded publishers the place proper. You'll be able to learn more regarding the requirements we stick to in producing precise, impartial information in our

Repayment time period length: In combination with the APR, the following most important factor affecting the scale of your respective loan payment is the repayment term. You’ll have the bottom All round borrowing charges if you select the shortest attainable repayment expression because you’ll pay out fewer fascination about the life of the loan.

Credible: A Market that lets you Look at presents from multiple lenders, ensuring you discover a reputable student loan refinance possibility that suits your preferences.

Upstart has no minimal credit rating score to qualify. And when you don’t Possess a credit history rating, you should still qualify for those who’ve graduated using an affiliate's diploma or greater or are at the moment enrolled inside of a method.

Offering an employer contact number significantly boosts your probabilities of getting a loan. When you are on benefits, You can utilize the phone number of The federal government Business that gives your Advantages. Enter Employer Cellular phone

An additional downside will be the acceptance of your software. Direct lenders have their own individual underwriting and loan conditions.

This solution encourages dependable borrowing and economical steadiness, underscoring the necessity of risk administration in own finance.

Though online lenders typically present competitive rates, people with reduced credit score scores should end up getting bigger desire fees compared to People with fantastic credit rating. Be mindful that turning to an internet loan might not preclude from secure favorable loan conditions in by itself.

Upstart has become the handful of personalized lenders that could give a loan to borrowers with credit rating scores of 300. That said, Despite having Upstart, you are going to still want as superior a credit history score as feasible to be able to get the best curiosity fee which you can.

In terms of undesirable credit history own loans, you'll find four principal types of costs that possible borrowers must be prepared for. Origination cost: An origination payment is one which's billed upfront by a lender as payment for processing a private loan software.

Loan Phrases: Take into account the size of the loan term And the way it influences your regular payments and complete desire compensated.

LightStream also provides a click here lot of the optimum loan limitations, longest loan phrases, and least expensive desire fees of any lender on our checklist.

Several economic institutions present individual loans, which include banking companies, credit history unions and on the net lenders. A private loan could assist you consolidate significant-curiosity debt or purchase a large invest in.

Your FICO rating considers the two constructive and negative data shown in your credit report (also known as your credit profile), and that is grouped into the subsequent 5 weighted types: Payment History (35%)

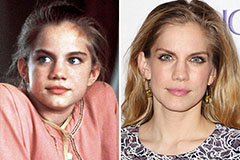

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!